Today’s guests are Doug Nordman and Carol Pittner.

- Click above or listen to the episode on your favourite podcast platform here (Apple Podcast, Spotify, Google Podcasts, Stitcher, Podchaser, Overcast, Castbox, etc)

Today’s Guest

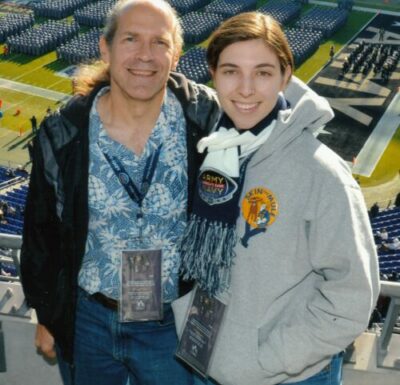

Doug Nordman and Carol Pittner

This father-daughter duo co-wrote a book that was released in 2020, called Raising Your Money-Savvy Family For Next Generation Financial Independence. Doug has been enjoying retirement in Hawaii after serving 20 years of active duty in the US Navy’s submarine force. He and his wife (who is also a retired Navy Reservist) reached FI in 1999 and Doug retired in 2002. He is also a blogger and military personal finance coach. Carol is also a US Navy Veteran, joining the Navy after college, serving on Active Duty, before switching to a part time Reservist role. She and her active duty spouse are also approaching Financial Independence, as they have started their family. Carol is based in San Diego.

You’ll Learn:

- What inspired Doug and Carol to write this book

- The importance of teaching delayed gratification skills

- The concept of one special thing

- The Bank of Carol Certificate Deposits system and how it helped with teaching delayed gratification as well as build credibility and trust with Carol about her money.

- How kids best learn about spending decisions through making bad choices and allowing them to make mistakes

- Learning about spending based on values of what was important to Carol

- How the progression of learning to order food from a young age helped Carol learn skills of being able to provide food for the family, along with handling money, getting correct change and making sure the quality of food was right

- The concept of 20 minutes a day

- The importance of paying a regular allowance, without making it contingent on good behaviour

- How introducing financial incentives and sharing the profits with Carol provided ways for her to earn money, while giving her increasing amounts of responsibility and freedom

- The importance of thinking about the entire lifecycle of an item, when making purchases

- The concept of the Kid 401(k) and how it was used to teach Carol delayed gratification in saving for a future car

- What Carol will do differently in teaching her daughter about finances

Resources

- The First National Bank of Dad, by David Owen

- Choose FI, Kid 401(k) plan

- Simple Path to Wealth, by J L Collins

- Grab Your Slice of Financial Independence, by Monica Scudieri

- Taking Stock: A Hospice Doctor’s Advice on Financial Independence, Building Wealth and Living a Regret-Free Life, by Jordan Grumet, MD

- Follow and tag moneydadpodcast on Instagram to comment on topics and ideas discussed during the episode that resonated with you or share with a friend

Thanks for listening!

Have some feedback you’d like to share? Leave a note in the comment section below!

If you enjoyed the episode, please share it on Instagram.

Like this show? Please leave a review on Apple or Podchaser – even one sentence helps! Ratings and reviews are extremely helpful and greatly appreciated! They do matter in the rankings of the show, and I read each one of them. Post a screenshot of you listening in Instagram and tag me so I can thank you personally!

Don’t forget to subscribe to the show to get automatic updates. I’ll be dropping a new episode every TUESDAY!

Thanks to Doug and Carol for joining me this week!

In case you missed it, make sure to catch up on last week’s episode “Episode 040: Leading by Example: Creating a Healthy Money Mindset with Melanie Robinson”!

Leave a Reply